Know More About Pan Card !

Do you like this post?

Are you doing financial transactions in India whether you are Indian citizen or NRI, you must need PAN Card for it.

Know What is Pan Card?

Pan Card (Permanent Account Number ) is a combination of ten digit alphanumeric number, issued inform of a laminated plastic card by Income Tax Department of India. Each set of number is a unique set for Individual, HUF, Company. It is unaffected by change of address. It is issue only one time to any individual, HUF or Company whether they are situated in any states of India. Keeping more that one PAN Card is illegal and punishable.

The

PAN’s primary purpose is to bring a universal identification key factor that

links and tracks various documents and information regarding taxes and

financial transactions, such as loans, investments,

buying and selling real estate and other business

activities of taxpayers. By tracking the above it indirectly prevents tax

evasion through non-intrusive means.

Structure of PAN Card

The

structure of the new series of PAN numbers is based

using Phonetic Soundex code algorithm to ensure that each number is unique. The

following list is “constant permanent parameters” that assist in the creation

of phonetic PAN (PPAN) number:

The

structure of the new series of PAN numbers is based

using Phonetic Soundex code algorithm to ensure that each number is unique. The

following list is “constant permanent parameters” that assist in the creation

of phonetic PAN (PPAN) number:

i.

Full name of the taxpayer;

ii.

Date of Birth/Date of Incorporation

iii.

Status;

iv.

Gender in case of individuals; and

v.

Father’s name in case of individual (including in the cases of married ladies).

The

Date of Issue (DOI) of the PAN card can be found on the right hand side of the

photo on your PAN card.

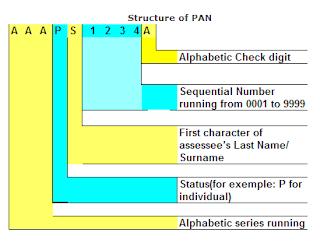

The 10 digit alphanumeric sequence.

Have a look at breakdown of 10 digit alphanumeric sequence.

1.

The first five fields are called the core fields and are alphabetical in

nature.

2.

The first three letters of the core field are an alphabetical series running

from AAA to ZZZ.

3.

The forth character of the PAN must be one of the following, depending on the

type of assesse:

C

– Company

P

– Person

H

— HUF (Hindu Undivided Family)

F

— Firm

A

— Association of Persons (AOP)

T

— AOP (Trust)

B

— Body of Individuals (BOI)

L

— Local Authority

J

— Artificial Juridical Person

G

— Govt

(Example

– Company = AAACA; Artificial Juridical Person = AAAJA; HUF = AAAHA;

etc.)

4.

The fifth character of the PAN is the first character of the following:

a)

Your surname in the case of “P” or;

b)

For all others you would use the first letter of the name of the Entity, Trust,

Society, Organization, HUF, etc.

(Example

– Lisa Chanamolu [Personal] = AAAPC4444A; Lisa Chanamolu [HUF] = AAAHL4444A;

General Firm = AAAFG4444A; etc.)

5.

The next four numbers are sequential numbers running

from 0001 to 9999.

6.

The last digit is an alphabetic check digit.

The new phonetic PAN (PPAN)

The new Phonetic PAN (PPAN) helps to prevent the allotment of more than

one PAN to assesses with the same or similar names. If a matching PPAN is

detected, a warning is given to the user and a duplicate PPAN report is

generated. In these cases, a new PAN can only be allotted if the Assessing

Officer chooses to override the duplicate PPAN detection. Under this new system

a unique PAN can be allotted to 17 crore taxpayers.

Myths about PAN

Many people believe that PAN cards are used for tax purposes only. That

is a myth. PAN numbers are required for the purpose of income tax but not the

actual card itself. Photocopies of PAN cards are required as prove of identity

in financial transactions such as opening a bank account, purchase and sale of

property and motor vehicles, home telephone lines and investments, such as

demat accounts and mutual funds, just to name a few.

How to Apply for a PAN Card

Anyone

can apply for a PAN card, whether they are working or not. There is no

restriction on age, region or nationality. You can submit an application for an

underage minor and even on behalf of a newborn. Applications must be signed by

a legal parent or guardian.

·

If the applicant has never applied for a PAN, does not have a PAN allotted to

them, they can visit the Income Tax Department (ITD) website. The first step is

to determine if a PAN has been allotted to them or not.

·

If a PAN has not been allotted to them they can apply

at the following sites. You can apply and track the progress of your

application through both of these websites:

·

To apply in person, use the following lists to find the nearest TIN-PAN

Centers,NSDL TIN Facilitation Centers or UTI PAN

Application Centers (for UTI, see list at bottom of page).

To

apply for a new PAN card you need to submit at least two proofs of Identify and

residence from the following sources:

·

Matriculation Certificate

·

Recognized Educational Institute Degree

·

Credit Card

·

Bank Statement

·

Ration Card

·

Driving License

·

Voter’s Identity Card

·

Passport

(The

above list is for individuals and HUF.)

Reprint

of PAN Card:

·

This application should be used when a PAN number has been allotted to you and

you need a PAN card. A new PAN card will be issued to you with the same PAN

number. Go to the NSDL website to apply for a reprint. You

can go to the above mentioned NSDL and UTI sites to verify or search your PAN

number.

Conclusion

It

is easy to see the importance of your PAN card and why you need the physical

card as well as the allotted PAN number. If you do not have a PAN card, take

the small amount of time need to apply for one today.

GET STATUS OF YOUR PAN CARD APPLICATION

GET STATUS OF YOUR PAN CARD APPLICATION

Subscribe to:

Post Comments (Atom)

0 Responses to “Know More About Pan Card !”

Post a Comment